Are you looking for ways to supplement your income? Whether you’re saving up for a big purchase, paying off debt, or just looking to increase your cash flow, a second income can be a great way to achieve your financial goals. In this article, we’ll explore some 2nd income source ideas to help you get started.

One of the easiest ways to earn a second income is by taking on a side job. There are many part-time jobs available that can be done outside of regular business hours, such as freelance writing, tutoring, or pet-sitting. You could also consider driving for a ride-sharing service or delivering food for a meal delivery service.

Another way to earn a second income is by starting your own business. This could be anything from selling products on eBay to creating your own online course. With the rise of the gig economy, there are more opportunities than ever to turn your skills and passions into a profitable side hustle. So, if you’re ready to start earning more money, keep reading for some 2nd stream of income ideas that you can try today.

Table of Contents

Understanding 2nd Incomes

If you’re looking for ways to increase your income, then you might want to consider a second income. A second income can provide you with additional financial security and help you achieve your financial goals faster. In this section, we’ll explore the benefits of having multiple income streams and some challenges and considerations to keep in mind.

Benefits of Multiple Income Streams

Having multiple income streams can provide you with several benefits. Firstly, it can increase your overall income, which can help you pay off debts, save for retirement, or invest in your future. Secondly, it can provide you with a safety net in case you lose your primary source of income. Thirdly, it can help you diversify your income, which can reduce your financial risk.

There are several ways you can generate a second income. For example, you can start a side business, invest in stocks or property, or take on a part-time job. You can also consider freelancing, selling products online, or offering consulting services.

Challenges and Considerations

While having a second income can be beneficial, there are some challenges and considerations to keep in mind. Firstly, it can be time-consuming, especially if you’re already working full-time. You’ll need to find a way to balance your work and personal life effectively. Secondly, it can be stressful, as you’ll need to manage multiple income streams and ensure that they’re all generating enough income. Thirdly, it can affect your taxes, so it’s important to consult with a financial advisor to understand the tax implications of having multiple income streams.

When considering a 2nd source of income, choosing a source of income that aligns with your skills, interests, and values is essential. It’s also important to set realistic expectations and goals for your second income. For example, if you’re starting a side business, you’ll need to have a solid business plan and marketing strategy in place to ensure its success.

Overall, having a second income can provide you with several benefits, but it’s important to weigh the pros and cons carefully before making a decision. By understanding the benefits and challenges of having multiple income streams, you can make an informed decision that aligns with your financial goals and lifestyle.

2nd Income Source Ideas

If you’re looking for ideas for a second income source, here are some options to consider:

- Freelancing: Offer your skills and services to clients freelance, such as writing, graphic design, or web development.

- Part-time job: Look for part-time job opportunities in your field or a related field.

- Rental property: Invest in a rental property and generate passive income through rent.

- Stock market: Invest in stocks and earn dividends or capital gains.

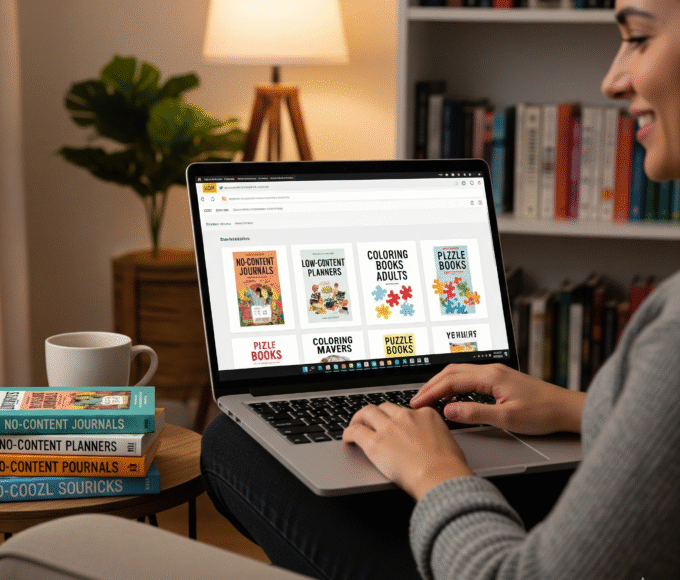

- Online store: Sell products online through platforms like Amazon or Etsy.

- Consulting: Offer your expertise to businesses or individuals in your field.

- blogging: Start a blog and earn money through advertising or affiliate marketing.

2nd Stream of Income Ideas

If you’re looking for ideas for a second stream of income, here are some options to consider:

- Rental property: Rent out a spare room in your home on platforms like Airbnb.

- Dividend stocks: Invest in stocks that pay regular dividends.

- Peer-to-peer lending: Invest in peer-to-peer lending platforms and earn interest on your investments.

- Affiliate marketing: Promote products or services and earn a commission on sales.

- Online surveys: Participate in online surveys and earn money or rewards.

- Pet-sitting: Offer your services as a pet-sitter or dog-walker.

- Renting out your car: Rent out your car on platforms like Turo.

Online Income Opportunities

If you’re looking for a second income source, then the internet is a great place to start. There are many online income opportunities that you can explore. Here are some ideas to get you started:

Freelancing and Consulting

If you have skills that are in demand, then you can offer your services as a freelancer or consultant. Freelancing platforms such as Upwork, Freelancer, and PeoplePerHour can connect you with clients who need your skills. You can offer services such as writing, graphic design, programming, social media management, and more.

Consulting is another option if you have expertise in a particular field. You can offer your services to businesses or individuals who need advice on a specific topic. For example, if you’re an accountant, you can offer financial consulting services to small businesses.

Digital Products and Services

Creating and selling digital products and services is another way to earn a second income online. You can create ebooks, courses, software, or apps and sell them on platforms such as Amazon, Udemy, or your own website.

You can also offer digital services such as web design, copywriting, or video editing. You can find clients on freelancing platforms or by promoting your services on social media.

Affiliate Marketing and Blogging

Affiliate marketing and blogging are two more online income opportunities that you can explore. With affiliate marketing, you promote other people’s products and earn a commission for each sale that you generate. You can promote products through your blog, social media, or email marketing.

Blogging is another option if you enjoy writing and sharing your thoughts with others. You can monetize your blog through advertising, sponsored posts, or affiliate marketing. You can also sell digital products or services through your blog.

In conclusion, there are many online income opportunities that you can explore. Whether you choose to offer your services as a freelancer or consultant, create and sell digital products, or promote other people’s products through affiliate marketing, the internet offers endless possibilities for earning a second income.

Passive Income Strategies

If you’re looking for a way to earn money without putting in constant effort, passive income strategies are a great option. Here are some ideas for generating passive income:

Investment Income

Investing in stocks, bonds, or mutual funds can be a great way to generate passive income. The key is to find investments that will generate regular dividends or interest payments. This will allow you to earn money without having to actively manage your investments.

One popular strategy is to invest in dividend-paying stocks. These are stocks that pay regular dividends to their shareholders. Some companies even increase their dividends every year, which can provide a reliable source of income over time.

Another option is to invest in bonds or bond funds. Bonds are debt securities that pay regular interest payments to their holders. Bond funds are mutual funds that invest in a portfolio of bonds. Both can provide a steady stream of income without requiring much effort on your part.

Rental Properties

Owning rental properties can be a great way to generate passive income. When you own a rental property, you can earn money from the rent that your tenants pay each month.

To be successful with rental properties, it’s important to choose the right location and property type. You’ll also need to be prepared to handle the responsibilities of being a landlord, such as finding tenants, collecting rent, and maintaining the property.

Royalties from Intellectual Property

If you have a talent for writing, music, or art, you can earn passive income from royalties on your intellectual property. For example, if you write a book, you can earn royalties from book sales. If you compose music, you can earn royalties from streaming services and downloads.

To be successful with this strategy, you’ll need to create high-quality intellectual property that people want to consume. You’ll also need to be prepared to market your work and negotiate royalties with publishers or distributors.

Overall, passive income strategies can be a great way to generate additional income without putting in a lot of effort. By investing in stocks or bonds, owning rental properties, or creating intellectual property, you can earn money while focusing on other areas of your life.

Part-Time and Seasonal 2nd Income Jobs

Part-time and seasonal jobs can be a great option if you are looking for a way to earn a second income. These jobs offer flexibility, allowing you to work around your existing schedule. Some popular part-time and seasonal jobs can help you earn extra cash.

Retail and Customer Service

Retail and customer service jobs are great for earning a second income. These jobs are often available part-time or seasonal, making them a flexible option. Some popular retail and customer service jobs include:

- Sales associate

- Cashier

- Customer service representative

- Retail merchandiser

These jobs typically require good communication and customer service skills. They may also require you to work weekends and holidays.

Tutoring and Education

If you have expertise in a particular subject, you can earn a second income by tutoring others. Tutoring can be done in-person or online, and can be a flexible option that allows you to work around your existing schedule. Some popular tutoring and education jobs include:

- Private tutor

- Online tutor

- Substitute teacher

- Test prep tutor

These jobs typically require knowledge of a particular subject or skill, as well as good communication and teaching skills.

Turning Student Life into a $10,000 Adventure | Somquest

Gig Economy and Delivery Services

The gig economy and delivery services offer a variety of opportunities to earn a second income. These jobs are often flexible and can be done on a part-time or seasonal basis. Some popular gig economy and delivery jobs include:

- Uber or Lyft driver

- Food delivery driver

- TaskRabbit tasker

- Amazon Flex driver

These jobs typically require a reliable vehicle and good time management skills. They may also require you to work evenings and weekends.

Overall, part-time and seasonal jobs can be a great way to earn a second income. By exploring different job options and finding one that fits your skills and schedule, you can start earning extra cash in no time.

Starting a Side Business

If you want to generate a second income, starting a side business could be a great option. Not only does it provide the potential for earning extra money, but it can also be an exciting opportunity to pursue a passion or interest. However, starting a business requires planning, strategy, and careful consideration of legal and financial factors.

Business Planning and Strategy

Before starting a side business, it’s important to develop a clear plan and strategy. This includes identifying your target market, defining your unique selling proposition, and creating a business plan that outlines your goals, objectives, and financial projections. You may also want to consider factors such as pricing, product or service development, and operational logistics.

Marketing and Brand Development

Once you have a clear plan in place, you’ll need to focus on developing your brand and marketing your business. This includes creating a strong visual identity, developing a website and social media presence, and creating marketing materials such as business cards, flyers, and brochures. You may also want to consider advertising or promotional campaigns to help generate awareness and attract customers.

Legal Considerations and Structure

Starting a side business also requires careful consideration of legal and financial factors. This includes choosing a business structure such as a sole trader or limited company, registering your business with HMRC, and obtaining any necessary licenses or permits. You may also want to consult with a lawyer or accountant to ensure that you’re complying with all relevant laws and regulations.

Overall, starting a side business can be a great way to generate a second income. By developing a clear plan, focusing on branding and marketing, and carefully considering legal and financial factors, you can increase your chances of success and achieve your financial goals.

Frequently Asked Questions

What are effective methods for generating a secondary source of income?

There are several effective methods for generating a secondary source of income, including starting a side business, freelancing, investing in stocks or real estate, and renting out a property. It’s important to choose a method that aligns with your skills, interests, and financial goals.

Which passive income investments offer the best return with minimal risk?

Passive income investments that offer the best return with minimal risk include dividend-paying stocks, rental properties, peer-to-peer lending, and index funds. It’s important to do your research and consult with a financial advisor before making any investments.

How can one create multiple income streams without substantial upfront investment?

One can create multiple income streams without substantial upfront investment by leveraging their skills and resources. For example, starting a blog, creating an online course, or offering consulting services can all be done with minimal investment. It’s important to focus on creating value for your customers and building a strong brand.

What are some viable options for earning a second income alongside a full-time job?

Some viable options for earning a second income alongside a full-time job include freelancing, starting a side business, selling products online, and renting out property. It’s important to find a balance between your full-time job and your second income, and to make sure you have enough time and energy to devote to both.

In what ways can young adults establish a passive income early in their careers?

Young adults can establish a passive income early in their careers by investing in stocks or real estate, creating a side business, or offering freelance services. It’s important to start early and be consistent in your efforts to generate passive income.

What strategies exist for developing a sustainable second stream of income with limited resources?

Strategies for developing a sustainable second stream of income with limited resources include focusing on high-value activities, leveraging your existing skills and resources, and building a strong brand. It’s important to be patient and persistent, and to continually look for ways to improve and grow your second income stream.