What is a Payoneer? It is a platform that helps you send and receive payments from merchants. You do not require a merchant account separately. With its adaptability and ease of access, Payoneer has made cross-border payments easy. Simply create a Payoneer account and start using it without any fuss.

To receive payments, all you have to do is to send in a payment request to the merchant. Once approved, the payment comes into your account swiftly. If you need to learn about Payoneer and Payoneer accounts, you have come to the right place. Read the article for a detailed review of Payoneer and Payoneer ratings.

Table of Contents

Does Payoneer accept payments across the globe?

Yes, having a Payoneer account offers payments across the world. You can send and receive payments from local bank transfers to and from companies and marketplaces. The major currencies supported by Payoneer are the US, UK, Australia, Canada, Japan, and Mexico.

Payoneer Services

Creation of a Payoneer account is free. Once it is created and verified, log in Payoneer account and use their services hassle-free. Payoneer offers its services around the globe. We have discussed its services below for your better understanding of Payoneer and how it works.

Global Payments

Payoneer allows businesses to receive or send payments to local banks, and even international transactions are done swiftly. To receive a payment, you must send a payment request, which is made in a matter of seconds. Payoneer also supports wire transfers where one cannot create local accounts.

Invoice Creation

Payoneer has integrated software on its website that allows the creation of invoices to send to vendors or merchants. An individual can customise the invoices at one’s ease and requirements. Customising each company or client with their company name and details can be done smoothly.

Debit Card

Payoneer account holders can have their hands on Payoneer Mastercard, which makes transferring payments more efficient. The cards work on any ATM worldwide, but transactions cost a certain fee. The cards have options for physical and virtual cards. A virtual card is complimentary, while a physical card costs $40 per year.

Mobile App

With the rise of smartphone usage and technology in the hands of everyone, things have changed manifold. Where new apps are being developed at rabbit’s pace every day, Payoneer also has introduced its mobile application. It is available on Android and iOS, allowing you to make payments, withdraw funds, and view transactions on your device.

Security

Where technology is changing with leaps and bounds, digital thefts have also increased manifold. Protection of your card data is essential with each passing day. Payoneer has PCI-compliant services to protect your card data and anti-money laundering regulations. Moreover, Payoneer also offers fraud detection to its customers.

Tax

Completing associated tax forms is also necessary when creating a Payoneer account. Individual and business tax forms such as W-9s, W-8BENs and W-ECIs are supported by Payoneer. Furthermore, Payoneer offers automated record-keeping for tax reports through its integrated systems.

Payoneer: How it Works

When you create an account with Payoneer, one thing that comes to mind is how it works. Well, we’ve answered this query for you below.

- If you are a business, you send a payment request to your customer directly. The customer will accept and pay you through a bank transfer or a credit card.

- The transactions reflect in the business’s account. Once done, the business either withdraws it to its physical bank account or uses it from a Payoneer card only.

Usually, payments reflect in the accounts immediately, but it may also take two to five days for the payments to be reflected in the business’s accounts. Once the payments are received, they are ready to be utilised via Payoneer MasterCard or transferred to a local bank account.

To send a payment from one Payoneer account to another, the option of ‘Make A Payment’ is used. Enter the other account’s details, and the transfer is done within seconds, free of charge. But, you may have to pay a percentage of the transaction if the transfer is initiated to a local bank.

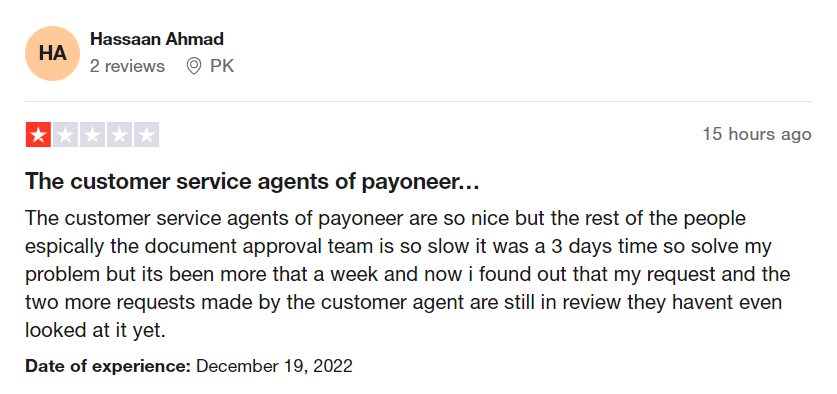

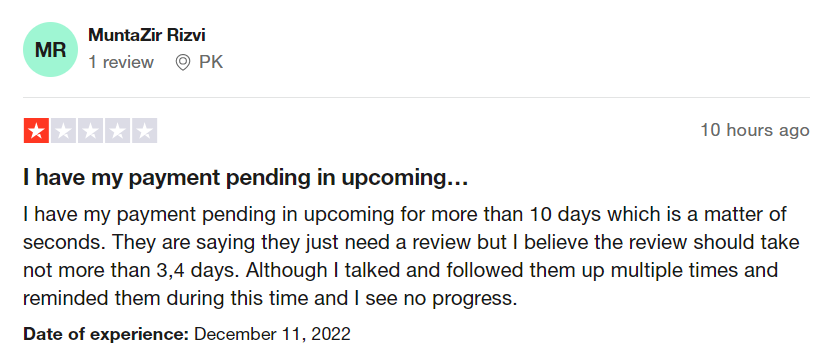

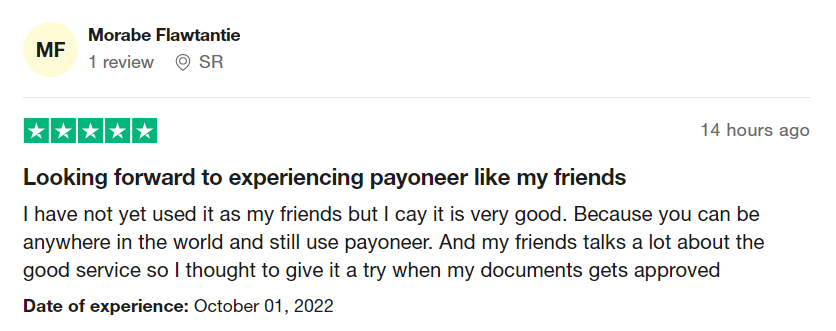

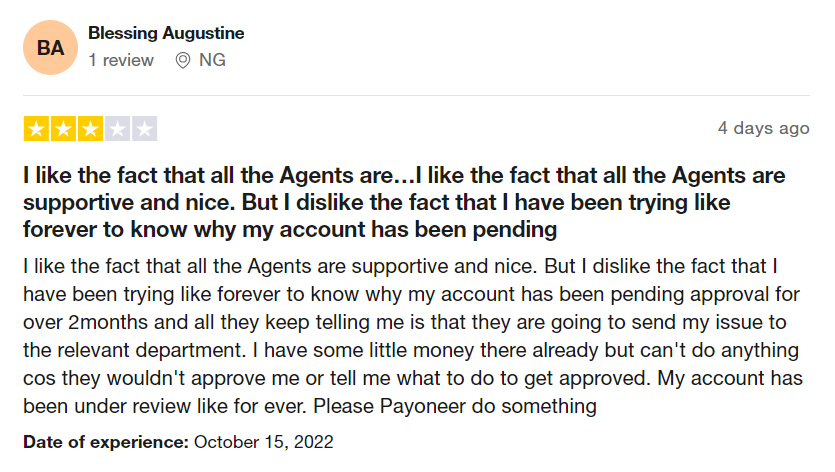

Review Payoneer

Payoneer is one of the leading online payment methods recognised globally. Payoneer account holders know the pros and cons of having an account with them. However, Payoneer has mixed reviews regarding its services online. To help you with an idea, we’re attaching a few below.

Pros & Cons

| Pros | Cons |

| Free account creation | Transaction fees are on a higher end |

| Free payments across other Payoneer accounts. | The physical card costs $40 annually. |

| It is an open-source software. | No card offers or promotions |

| Withdrawal to bank accounts is easy | Customer service is relatively slow |

| More prominent brands also utilise its services | Account termination on suspected fraud |

Payoneer Fee Structure

Each service provided by any company has its service charges. Similarly, Payoneer accounts have charges for each service you utilise. Although Payoneer has its name and fame for virtual payments across the globe and its ease of use and easy integration of software etc., it also has transaction fees enabled with its services.

If you are getting paid for your services, you’ll receive payments from another Payoneer account, a debit or credit card, or a marketplace. Each service has different charges depending on the complexity of the services. Here is an explanation:

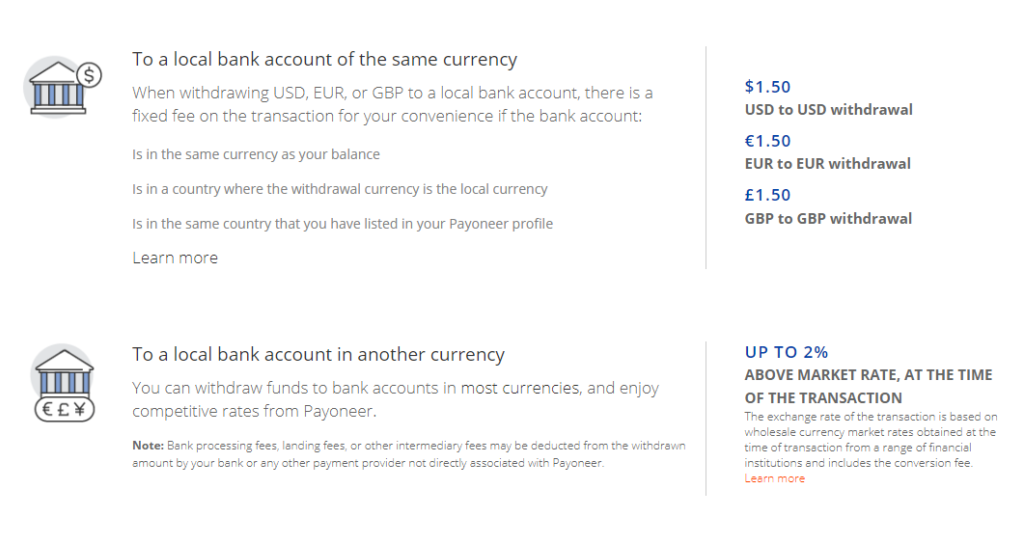

Once you receive a payment, you’ll withdraw it to a bank account. That, too, has its service charges. See below to look for the service changes by Payoneer for withdrawal into your account.

Paying from Payoneer has also been made easy. You do have to pay others for the services you have utilised. Partnering with Payoneer has its benefits here.

One may hold some foreign currency in their accounts besides payment transfer and using their services. The account that remains inactive has its charges too. Look below to learn more about miscellaneous charges charged on an annual basis.

Conclusion

Payoneer is a well-established company that has become a decent fintech banking option. Multiple big brands are using Payoneer accounts, and its ease of use has made it a competitor to some famous fintech companies. Payoneer ratings on the internet are 4.3 regarding its services and customer support.

However, the payments to non-Payoneer accounts have a high transaction charge with an average Payoneer support chat. Payoneer also charges an annual fee to have its card or if you have an account that is not active. So what are you waiting for? Use this platform for your secure online payments. Visit somquestblog to learn more.

Leave a comment