Do you feel insecure about transferring money through a digital platform? Want a scam-free forum for money transfers? No need to scroll dozens of pages. We have skimmed a perfect choice for you. Have a look at this Remitly UK review- a glassdoor for money transfers. Try this wholly secured and authentic platform and make your money exchange simple.

Table of Contents

Is Remitly Safe?

If you consider Remitly a high-stakes venture, take it easy. Remitly is safe. It is a regulated platform with a robust security protocol. However, before using Remitly, you must provide identification and complete personal information. It encrypts all your info and uses two-factor authentication and firewalls to secure your private data.

What is Remitly UK?

Remitly UK is an online remittance service. This digital money transfer system aims to make the money transfer process easy, affordable, faster, and more transparent. This unsung hero with digital service works without any physical locations. Remitly is a company specialising in international quick and straightforward money transfers for individuals.

It offers services in countries like the US, UK, Canada, and other countries for those who send funds back home. Remitly UK provides reasonable fees with a convenient, fast, and easy service for the recipients to receive cash.

How Remitly UK Works?

This Seattle-based company allows its users to send money to friends and family in different countries. Remitly UK is available in more than 90 countries. With Remitly, users send money via credit or debit cards, mobile wallets or bank accounts. This handy tool has been praised for its fast transfers and low service charges.

Apart from that, the company offers its customers a mobile app that makes it trouble-free to send money on the go. Plus, its functional ability varies in different services. It depends on various factors like

- How much money you are sending.

- The way you like to pay for your transfer.

- The currency you are going to transfer.

- How you select to transfer your money.

- The country where you send money.

Remitly UK Pricing

Using Remitly is just a walk in the park. With Remitly, you only need to pass different verification tiers to send higher amounts of money. To increase your money transfer limits you will have to provide your personal details and information and upload certain documents. Different tiers have different limitations as mentioned in the table.

| Duration | Tier 1 | Tier 2 | Tier 3 |

|---|---|---|---|

| 24 Hours | $2,999 | $6,000 | $10,000 |

| 30 Days | $10,000 | $20,000 | $30,000 |

| 180 Days | $18,000 | $36,000 | $60,000 |

Features of Remitly UK

Exchange Rates

The most prominent thing about Remitly is its competitive exchange rates in the market. Its exchange rates are updated on a daily basis to stay consistent with market ups and downs. Check out its rates before your money transfers to understand the fluctuations.

Customer Service Support

Remitly, customer service support is available in more than twenty different languages. This support system is available 24/7 for English speakers all year round. You can take advantage of the facility via phone call, email, or chat.

Fastest Money Transfer

You have two different options to choose from in terms of money transfer speed. The first one is the “Economy” option, which takes up to 3-5 business days for the money transfer. Senders can enjoy a higher exchange rate for a minimum transfer fee.

The other option is the “Express” option. Through this, the sum will reach the recipient within a few hours after the transfer is made. However, you will have a lower exchange rate. But sometimes, it contains a higher transaction fee than the Economy option. You can also pay through your debit or credit cards.

Different Ways of Sending Money

Remitly gives multiple ways of receiving and sending money digitally. You can make payment for the money transfer from your bank account, debit or credit cards and mobile wallets. Your recipient can receive the money in their bank account or cash pickup at one of their agent locations worldwide.

Plus, its service of money home delivery to the recipients is icing on the cake. Keep in mind that all the delivery options are only available in some of the locations. This service does not apply to all countries.

Secure and Authentic

Remitly UK are as safe as the home. The company generally has a robust security system. It has an authentic track record and owns its compliance responsibilities on a serious note. Your sensitive data is completely safe with them. Besides, Remitly also has a money-back guarantee in case of any loss of funds through negligence or error.

How Can You Sign up for Remitly?

You need not break the bank to sign up for Remitly. It is entirely free. All you have to do is just sign up for Remitly and send money internationally. It provides excellent exchange rates, a useful website, a secure app, and fast delivery options. There are two ways to join Remitly:

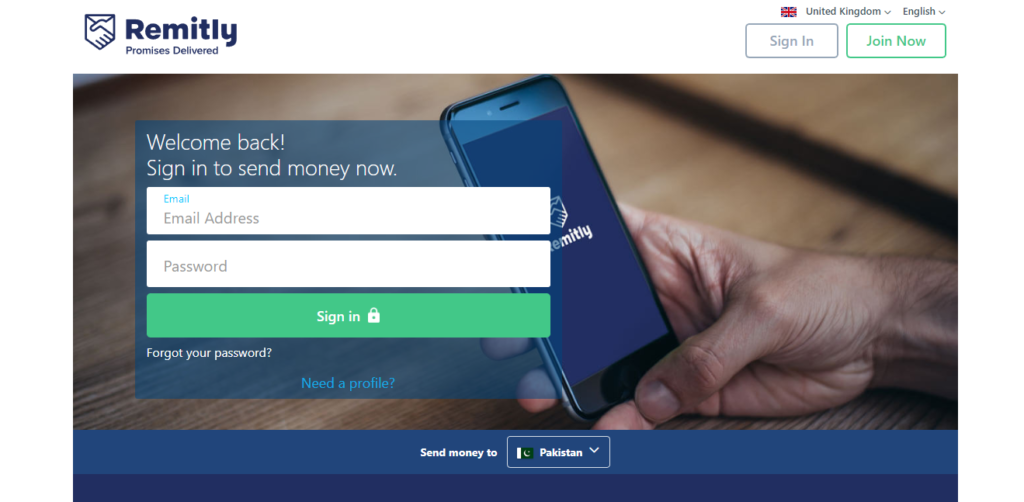

1. Sign in Using the Website

- First of all, go to the website

- Click on “Join Now” on Remitly.com.

- Enter your email address and enter your password.

- Select the “Join” option, and that’s all.

2. To Join Remitly Using App

- The first step is downloading the Remitly app from Google Play Store or Apple Store.

- Then, enter the country where you’re sending it from.

- Select the country where you’re sending to.

- After it, select “Next”

- Enter your email address.

- Set a password.

- In the end, select “Join Remitly”

Pros & Cons

Pros

- User-friendly system with online applications.

- Ease to collect money at any Remitly banking network.

- Multiple payout options, like mobile wallet, bank transfer, and home delivery.

- 24/7 service for customers

- Text message alerts for both the sender and the recipient.

- Refund the fees you paid in case of your dissatisfaction.

- Secure website and secure money transfer.

- No transfer fees to certain countries.

Cons

- Daily and monthly limitations on how much you send.

- Higher fees for debit or credit card fund transfers.

- Limitation of some transfer methods.

- High transfer fees to certain countries.

Conclusion- Remitly UK Review

If you are still worried about securing your money transactions, hold your horses. We have provided you with a fine-and-dandy option for a scam-free money transfer. Use Remitly to make your money transfer fast, simple, and secure. Its services are available in different packages that aim to help you in different countries of the world. So, let’s move to Remitly. Visit somquestblog to learn more.

Leave a comment