Are you looking for the best crypto trading platform to suit your needs? With the rapid growth of cryptocurrency, choosing the right platform can feel overwhelming. The ideal crypto trading platform should offer a user-friendly experience, a variety of trading options, and robust security features to protect your investments.

When exploring different options, you may encounter various terms like crypto exchange and cryptocurrency exchange. Understanding these platforms is essential for making informed decisions. A reliable crypto exchange allows you to buy, sell, and trade cryptocurrencies easily, while the best options trading platforms provide additional strategies for maximising your earnings in this volatile market.

Navigating the world of crypto doesn’t have to be daunting. By familiarising yourself with the best exchanges and their unique features, you can find a platform that aligns with your trading style and goals. Get ready to dive into the dynamic landscape of crypto trading, where smart choices can lead to exciting opportunities. Let’s discuss it in detail.

Table of Contents

What is a Crypto Trading Platform?

In simple terms, a crypto trading platform is a digital marketplace where you can buy, sell, and trade cryptocurrencies. Think of it as your online shop for digital coins, where you can swap Bitcoin for Ethereum or even dabble in lesser-known altcoins. The right platform can make all the difference in your trading experience, so let’s explore what makes a crypto trading platform the best.

Top Crypto Trading Platforms in 2024

Now that you know what to look for, let’s dive into some of the best options for crypto trading platforms this year.

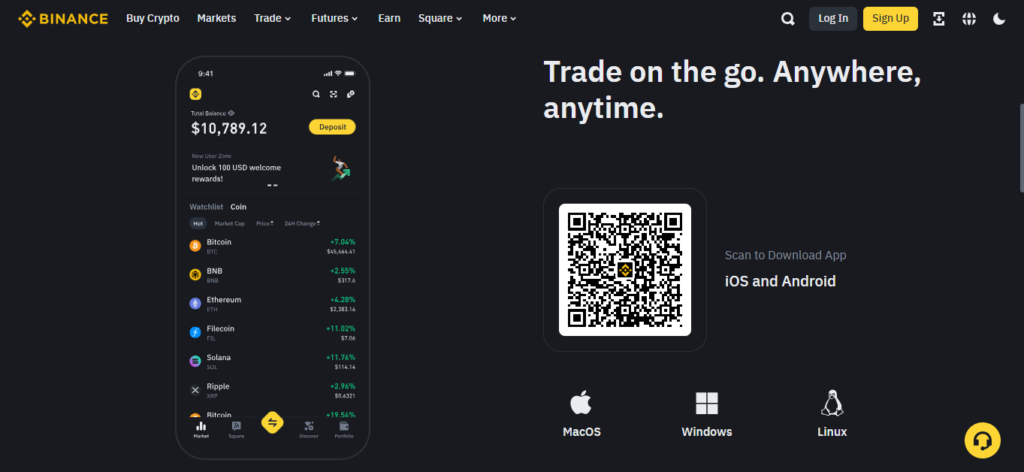

1. Binance

Binance is often hailed as the king of crypto exchanges. With a user-friendly interface, a vast selection of cryptocurrencies, and competitive fees, it’s no wonder traders flock to this platform. Plus, their advanced trading options make it suitable for both beginners and seasoned pros.

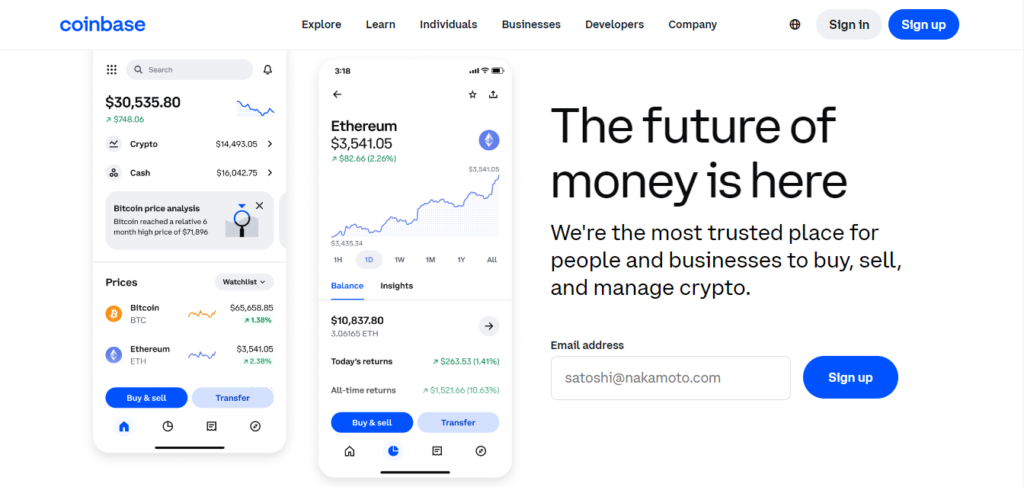

2. Coinbase

If you’re just starting out, Coinbase might be your best bet. Its simple design and educational resources make it easy for newbies to understand the ropes of crypto trading. While fees can be a bit higher than some competitors, the security features and ease of use are well worth it.

How To Buy Crypto On Coinbase.com

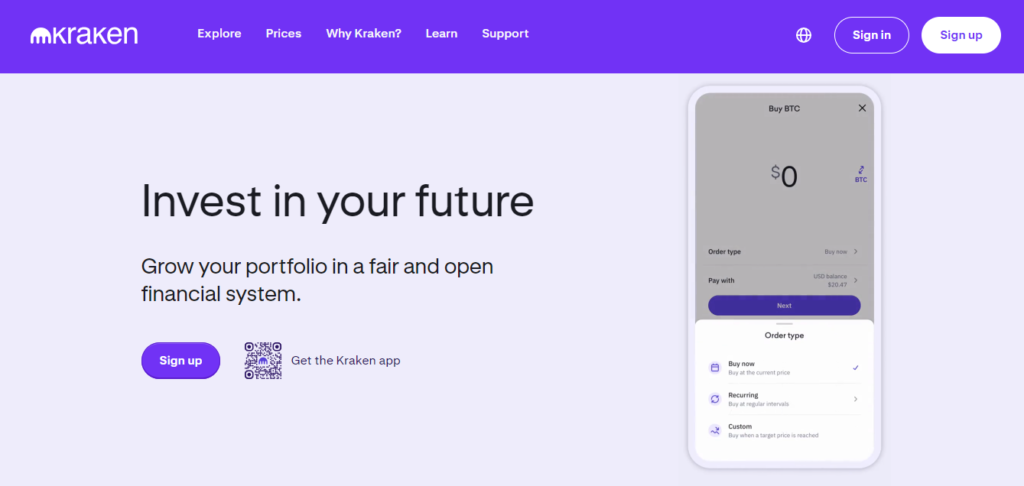

3. Kraken

Kraken is known for its strong security measures and a wide range of available cryptocurrencies. It’s a fantastic choice for those looking to explore crypto options trading. With a solid reputation in the industry, Kraken stands out as a reliable platform.

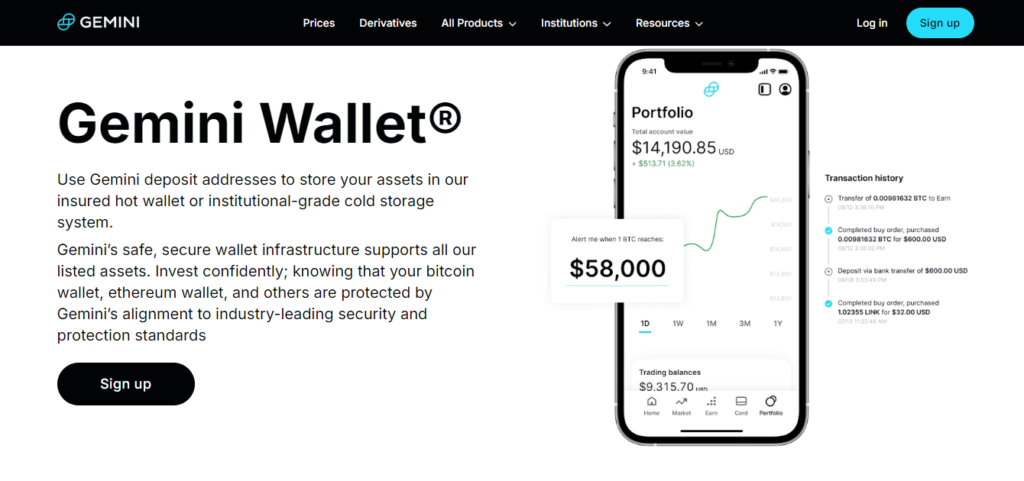

4. Gemini

Gemini prides itself on being one of the most secure exchanges out there. With a focus on regulatory compliance, it’s a great option for those who prioritize safety. Plus, their user-friendly app makes trading on the go a cinch.

5. eToro

eToro offers a unique social trading experience, allowing you to copy the trades of successful investors. This feature is perfect for beginners who want to learn from the best while building their own portfolio. With a variety of cryptocurrencies available, eToro is definitely a contender for the crypto trading platform best title.

Tips for Successful Crypto Trading

Now that you’ve got a handle on the best platforms, here are some tips to help you navigate the world of crypto trading:

– Do Your Research: Before investing in any cryptocurrency, take the time to understand its fundamentals. Knowledge is power, and the more you know, the better your chances of success.

– Start Small: It’s tempting to go all in, but starting small can help you learn the ropes without risking too much. As the saying goes, “Don’t put all your eggs in one basket.”

– Stay Updated: The crypto landscape is ever-changing. Keep an eye on market trends and news to make informed decisions.

– Practice Patience: Crypto trading can be a rollercoaster ride. Don’t let emotions drive your decisions; stay calm and stick to your strategy.

Essential Features of Crypto Trading Platforms

When choosing a crypto trading platform, several features can significantly impact your trading experience. Understanding these elements helps you make an informed choice that suits your needs.

Security and Regulation

Security is paramount in the world of crypto. Look for exchanges that implement robust security measures, such as two-factor authentication, cold storage for funds, and encryption protocols. Platforms should also comply with regulations in your jurisdiction, ensuring a level of trust and legal protection.

For instance, a regulated exchange must undergo audits and hold customer funds separately. This adds a layer of safety against potential hacking attempts. Always check for any past security breaches and how they were handled. A platform’s ability to protect your assets should be a top priority.

User Interface and Experience

The user interface of a crypto trading platform plays a crucial role in your trading efficiency. You need a platform that is easy to navigate, with a clear layout and accessible features. A well-designed dashboard allows you to track market trends, execute trades, and manage your portfolio without hassle.

Consider platforms that offer customisable layouts, letting you arrange information that matters to you. Mobile apps can enhance your trading experience by allowing you to trade on the go. A seamless user experience can make the difference between successful trading and costly mistakes.

Asset Diversity and Trading Pairs

A robust crypto trading platform should support a wide range of cryptocurrencies and trading pairs. This diversity allows you to explore different investment options and build a varied portfolio. Look for exchanges offering popular coins like Bitcoin and Ethereum, as well as emerging altcoins.

Having multiple trading pairs helps you maximise profits through strategically timed trades. For example, if you’re interested in trading Bitcoin for a lesser-known altcoin, ensure the platform supports that pair. The availability of diverse assets can significantly influence your trading strategy.

Fee Structure and Transparency

Understanding the fee structure is vital when selecting a trading platform. Many platforms charge fees for trades, withdrawals, and deposits. Review the fee schedule carefully, as fees can take a significant chunk out of your profits.

Choose platforms that promote transparency around their fee structures. Hidden costs can be a headache for traders, so look for exchanges that provide clear information about what you’ll pay. Always calculate how fees will impact your trading volume and profits before committing to a platform.

Customer Support and Education

Good customer support can make a world of difference, especially for newcomers to crypto trading. Ensure the platform offers multiple support channels, like live chat, email, and phone support. Quick response times can alleviate any issues you encounter during your trading journey.

Additionally, look for educational resources on the platform. Many of the best trading platforms provide tutorials, webinars, and articles to help you understand trading strategies and market trends. The more informed you are, the better your chances of making successful trades.

Comparing Top Crypto Trading Platforms

When choosing a crypto trading platform, it’s essential to consider several key factors. This includes the standout features, how well the platform performs, and its compliance with regulations. Let’s dive into the details.

Analysis of Best-in-Class Features

Top crypto trading platforms offer numerous features that can enhance your trading experience. Here are a few that stand out:

- User Interface: A clean, intuitive interface is crucial. Platforms like Binance and Coinbase have user-friendly designs that cater to both beginners and experienced traders.

- Trading Tools: Look for platforms that provide advanced trading tools. Features like charting options, technical indicators, and market analysis can be very helpful.

- Token Variety: The best platforms support a wide range of cryptocurrencies. This allows you to diversify your portfolio easily.

- Security Measures: Look for robust security features, such as two-factor authentication and cold storage for digital assets.

By focusing on these features, you’ll have a clearer idea of which platform suits your trading style.

Performance and Reliability

Performance is a vital aspect of any crypto trading platform. You want a site that operates smoothly without issues. Key points to consider include:

- Speed: The best trading platforms boast quick transaction speeds. Slow trades can lead to missed opportunities when market prices change rapidly.

- Uptime: Look for platforms with high uptime percentages. You don’t want to find your trading platform down when you need it most.

- Customer Support: Reliable customer support can be a game changer. Ensure the platform offers multiple channels such as chat, email, and phone support.

These factors contribute significantly to your overall trading experience. Always check user reviews to gauge performance.

Regulatory Compliance Across Jurisdictions

When it comes to trading cryptocurrencies, compliance with regulations is paramount. Not all platforms operate under the same rules. Consider these aspects:

- Licences: A legally operating platform will have appropriate licences in the jurisdictions they serve. This can indicate a commitment to regulatory standards.

- Transparency: The best platforms promote transparency. They should provide detailed information about their policies, fees, and security measures.

- International Regulations: Depending on where you live, different platforms may be preferable due to regulations specific to your region. Always verify that your chosen platform meets local laws.

By prioritising these compliance factors, you can ensure a safer trading environment.

Specialised Platforms for Options and Derivatives Trading

In the world of cryptocurrency, specialised platforms play a crucial role in options and derivatives trading. These platforms cater to specific trading needs, offering unique products and features that can enhance your trading experience. Here’s a closer look at what they provide.

Crypto Options Trading

Crypto options trading allows you to buy the right, but not the obligation, to buy or sell a cryptocurrency at a predetermined price within a certain timeframe. Platforms focusing on crypto options offer various strategies to manage risk and capitalise on market movements.

Leading exchanges, like Deribit and LedgerX, provide extensive options trading features. They often include tools for technical analysis, real-time data, and diverse trading pairs, making it easier to make informed decisions. Understanding different option types—like calls and puts—can empower you to create tailored investment strategies.

Futures and Other Derivative Products

Futures contracts are another type of derivative, where you agree to buy or sell an asset at a future date for a price agreed upon today. These contracts are widely used in crypto exchanges to hedge against price fluctuations.

Common platforms for futures trading include Binance and BitMEX. They provide leverage, enabling you to trade larger positions with a smaller amount of capital. This can amplify your profits, but it also increases risk. It’s vital to know your risk tolerance and use features like stop-loss orders to manage potential losses effectively.

Risk Management Tools

Utilising risk management tools on these platforms is essential for successful trading. Good platforms, such as Kraken and Coinbase Pro, offer various features like limit orders, stop orders, and advanced charting tools.

These tools help you set the parameters for your trades. For instance, a stop order can automatically sell your investment if it dips below a certain value, protecting you from significant losses. Additionally, understanding your own financial situation and employing sound risk management strategies can lead to more informed decisions while trading.

By leveraging these specialised platforms for options and derivatives trading, you can enhance your trading strategies and navigate the crypto market with more confidence.

Frequently Asked Questions

Which platform is considered the top choice for crypto trading in the current market?

Currently, platforms like Binance, Coinbase, and Kraken are often highlighted as top choices. They offer a wide range of cryptocurrencies, user-friendly interfaces, and robust security measures. Each platform has its advantages, so consider what matters most to you.

What features distinguish the best crypto exchange apps from the competition?

The best crypto exchange apps typically include features such as low fees, high liquidity, and advanced trading tools. User experience also matters; a simple and intuitive design can make trading easier. Additionally, strong customer support is essential to resolve issues quickly.How can traders in the US find the most reliable crypto exchange for day trading?

Which crypto exchanges are known for their expansive list of tradable options?

Exchanges such as Binance and Huobi are known for offering a vast selection of cryptocurrencies. These platforms allow traders to explore many pairs and options, which can be especially valuable for diversifying your portfolio. Check their listings to find the coins that interest you.

What should a user consider when choosing a cryptocurrency exchange for investment?

When selecting a cryptocurrency exchange, consider factors like security measures, fees, and ease of use. Look for exchanges with strong security features, such as two-factor authentication and cold storage for funds. It’s also wise to check for liquidity and trading volume to ensure you can execute your trades efficiently.

Are there legal considerations for using crypto exchanges in various countries?

Yes, legal considerations vary widely by country. Some nations have strict regulations, while others are more relaxed. Make sure to research the laws governing cryptocurrency trading in your country to ensure compliance and avoid potential issues. This can save you headaches down the line and ensure a smoother trading experience.